Whose standard of living?

- Helen and Mike

- Nov 18, 2022

- 3 min read

Money, they say, doesn’t matter – unless you haven’t got any!

Money definitely does matter. But however much or little you have, it is always, always symbolic. When people argue about money, it is not the wrongs and rights of the money itself that matters – although, of course, there are more and less moral ways of spending money. What matters is understanding what the arguments are really about in human terms!

The Chancellor of the Exchequer’s autumn statement yesterday was, as always, about so much more than money. Clearly there is a great deal of politics involved. Are the Tories handling money more wisely than the Labour Party would in the same circumstances?Does anyone know for sure? We may understand most of the individual pieces of vocabulary: interest rates, inflation, cost of living, national debt, GNP. But when it comes to understanding the economic pundits’ discussions about the long-term effectiveness or otherwise of the complex decisions being taken, who can be sure? The rich, do seem to be getting richer. And we're especially dubious about the effects of yesterday’s decisions on the lives of the poorest people!

And then there is the constant refrain describing the ‘fall in our standard of living’. That calculation seems to be based on the price of a ‘basket’ of products used by 'most people' and the rise in price of those products... This is the worst fall in our standard of living, we are being told, for decades. Some say 30 years, some say 40 years.

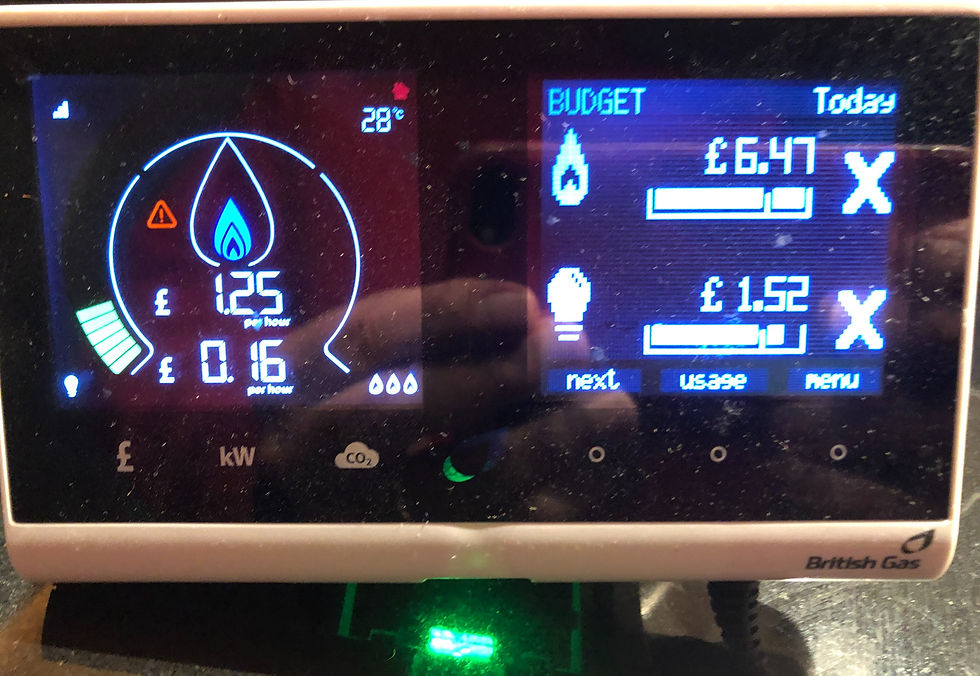

None of us who shop regularly can doubt the steep rise in prices. Prices go up all the time. The smart meter showing our hourly, daily electricity and gas consumption rises frighteningly high and fast most days, especially since the temperature has fallen.

So – when we hear that our living standards are about to fall, how do we respond? We wonder whether people of our post-war generation who grew up long before the cost of living record began have different attitudes. We had so much less then than we have now and we watched our parents scrimp and save for small treats which are today just everyday occurrences. Maybe we fear this ‘fall’ less than the later generations who have never really known such tight budgets. On the other hand, maybe we are suffering from defective memory!

Whatever our age, our relationship to money is ‘about’ so much. It's about dreams and wants and needs and knowing the difference between them. It’s about where we find security and which lacks and losses make us anxious. It’s about what gives us identity and satisfaction and whether we want immediate gratification or something more lasting. It’s about ambition or lack of it. And it’s always about power. Who has control of our purse strings? Who spends most in our families and our society - and what do they spend it on? And perhaps most of all who is trusted with resources and who is not?

Whether we like it or not, conversations about the supply of money becoming more scarce confront us with our own insecurities and offer each of us an opportunity to think about what we truly value. Especially in the west, the financial crisis offers us an opportunity to reflect on whether we accept what seems to be the public definition of ‘standard of living’ and how exactly we set our own!

Comments